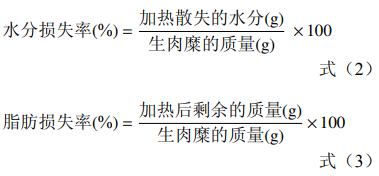

参考Colmenero等的淀粉度对方法略有改动,将蒸煮后所得液体全部倒入铝盒中,预糊影响置于105℃烘箱加热至恒重,化温和机减少的肉粉重量即为水分损失,恒重后的肠品铝盒总重减去空铝盒的重量即为脂肪损失。计算公式表达为:

根据Jia等所述的质特制研方法,用色差计来测定肉粉肠的淀粉度对亮度值(Lightness,L*值)、预糊影响红度值(Redness,化温和机a*值)和黄度值(Yellowness,肉粉b*值)。肠品将肉粉肠样品粉碎,质特制研并使用D65光源和10°观察仪(直径为8mm)进行测量,淀粉度对观察仪直径为8mm,预糊影响测量区域为50mm。化温和机测量之前,使用白色参考板(L*值=95.26,a*值=−0.89,b*值=1.18)进行校准。每组样品测量3次平行,每次平行将样品旋转3次至不同位置进行测量。

测定分别取长度、粗细均匀的样品进行质构测定。探头型号为P2,试验参数如下:测试前速度为1.5mm/s,测试速度为1.5mm/s,测试后速度为10.0mm/s,触发力为15.0g,样品首次轴向压缩未刺破肠衣,且压缩至原始高度的15.0%,测定指标包括:硬度、弹性和回复性。第二次轴向压缩刺破肠衣,且压缩至样品的75.0%。测定指标包括:脆性、咀嚼性和致密性。

参考Aursand等的方法略作改动,用圆柱形取样器(直径18mm)取18mm×18mm(高×直径)肉粉肠样品置于核磁试管中,使用低场核磁共振分析仪在室温(25℃)下测定自旋-自旋弛豫时间T2。使用CONTIN软件分析弛豫数据,弛豫时间分量表示为T2b、T21和T22,相关面积比例分别表示为A2b、A21和A22。测试参数:质子共振频率为22MHz,测量温度为32℃,重复扫描16次,重复间隔时间TR为3500ms,采样间隔160μs,回波个数为5000。每个样品平行测定6次,实验重复3次。

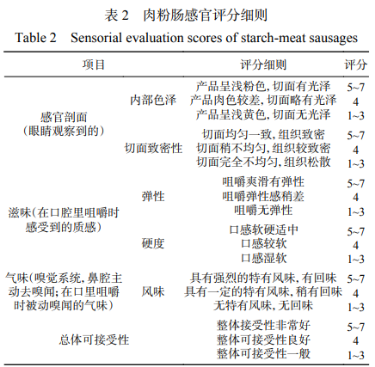

感官评价由感官小组(共16名成员,包括8位女性和8位男性)在感官实验室(ISO8589,2007)完成,评分细则如表2所示。肉类实验室的专家通过预备课程对所有小组成员进行了培训,以使他们了解样品。根据以下参数,通过感官描述分析以7个描述等级对每个肉粉肠进行评估:肉粉肠的内部颜色(1=偏浅黄色;7=偏浅粉色),肉粉肠的切面均匀度(1=低;7=高),肉粉肠的弹性(1=无弹性;7=口感爽滑有弹性),肉粉肠的硬度(1=极软;7=极嫩),肉粉肠的风味强度(1=较弱,7=最强)。此外,小组成员还需要提供每个肉粉肠的总体可接受性(1=低;7=高)。将室温的每组肉粉肠切成片(厚5~8mm),并放在随机编码的3位数的白板上,然后将所有样品立即交予小组成员。此外,还需向小组成员提供饮用水,避免测试不同样品之间味觉的混淆。

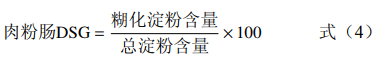

肉粉肠的DSG的计算公式如公式(4)所示,根据Liu等的方法测量总淀粉含量。此外,糊化淀粉含量的测量参考Liu等的方法略作改动,将25mg样品机械再溶解于80mmol/LNaOH溶液中,并用80mmol/L盐酸溶液中和。主要测量步骤包括:a.肉粉肠样品中总淀粉的机械再溶解;b.肉粉肠样品中糊化淀粉的机械再溶解;c.分别利用AGS酶酶解机械再溶解后的样品;d.利用KGLUC试剂盒分别测量酶解产生的D-葡萄糖含量;e.分别得出总淀粉含量和糊化淀粉含量,并利用公式(4)计算肉粉肠的DSG。

每个实验重复3次,结果以(平均值±标准差)表达。数据统计分析采用IBMSPSS25(IBMSPSS软件公司,Chicago,IL,USA)软件进行,差异显著性(P<0.05)分析使用TukeyHSD程序。利用Origin2018(OriginLab软件公司,Hampton,MA,USA)软件作图,Rversion4.0.3(MathSoft,Inc.USA)软件进行聚类分析(HierarchicalClusterAnalysis,HCA),讨论不同样品间参数的相似性。

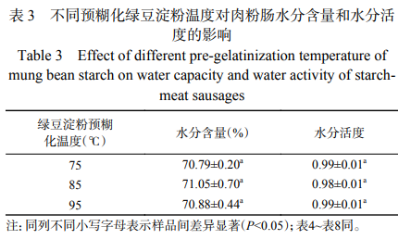

水分活度是指水分在食品中的存在状态,即水分子与食品的结合程度,较高的水分活度反映较低的结合程度。不同预糊化绿豆淀粉温度下的肉粉肠水分含量和水分活度如表3,由表3可知预糊化绿豆淀粉的温度对于肉粉肠样品的水分含量和水分活度无显著影响(P>0.05)。

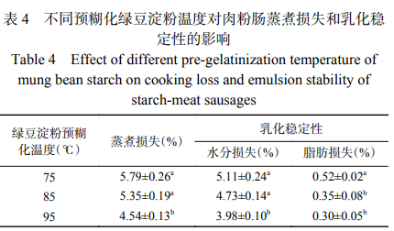

蒸煮损失和乳化稳定性是反映肉及肉制品品质的重要指标之一,而肉制品的乳化稳定性主要是由水分损失率和脂肪损失率体现。由表4可以看出,当预糊化绿豆淀粉温度增加至95℃时,肉粉肠的蒸煮损失、水分损失和脂肪损失分别显著降低(P<0.05)至(4.54%±0.13%)、(3.98%±0.1%)和(0.30%±0.05%),表明高预糊化淀粉温度会显著提高(P<0.05)肉粉肠的乳化稳定性,降低蒸煮损失。该现象可能是由于95℃时绿豆淀粉的DSG较高,在蒸煮过程中可以吸收肉中蛋白质因变性而析出的水分,同时图1中肉粉肠切面也表现出相同的趋势,由图1可观察到,75℃预糊化绿豆淀粉制备的肉粉肠切面内存在由于水分析出而形成的小水塘,导致切面不均匀,而95℃预糊化绿豆淀粉制备的肉粉肠切面则表现出良好的均一性。

声明:本文所用图片、文字来源《食品工业科技》,版权归原作者所有。如涉及作品内容、版权等问题,请与本网联系

相关链接:淀粉,绿豆,盐酸